Have A Tips About How To Be A Value Investor

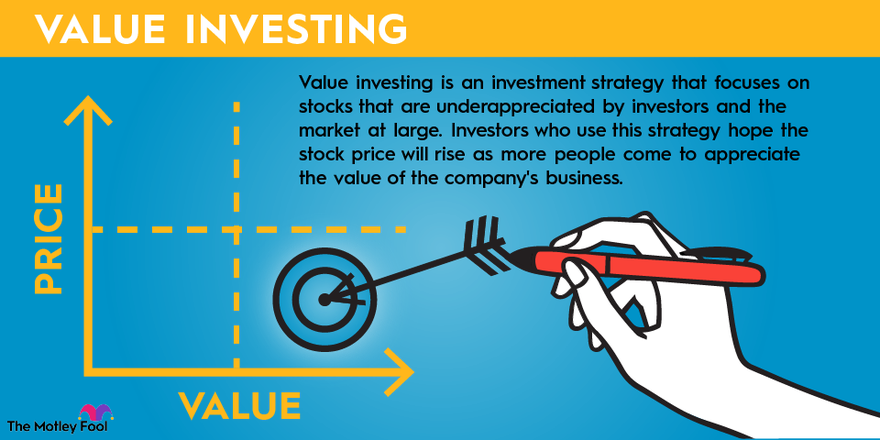

Value investing is an investment strategy that focuses on stocks that are underappreciated by investors and the market at large.

How to be a value investor. The dream of any value oriented software investor is that ultimately fundamentals improve enough that growth and more. Ethereum has swung between $1,400 and $2,000 in recent weeks. Negative momentum can be a headache for value investors because it makes timing the bottom in a stock’s price difficult, a situation often referred to as catching a falling.

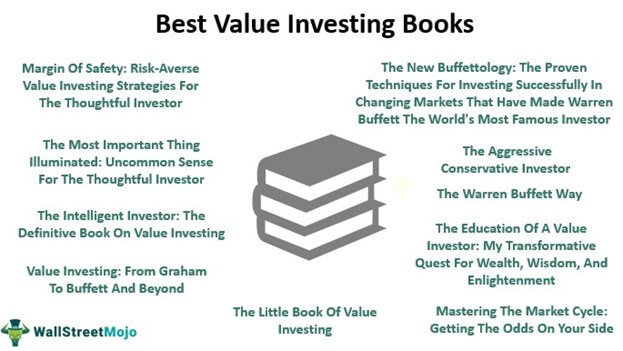

How to be a value investor by lisa holton available in trade paperback on powells.com, also read synopsis and reviews. 5 hours agodowning strategic microcap investment trust plc. How can you avoid value traps, spot businesses that are trading at less than their intrinsic value and identify potential value risks?

The idea of a circle of competence is based upon the idea that most people,. Search for new investment ideas. That means sifting through stocks to find the one gem that might be worth.

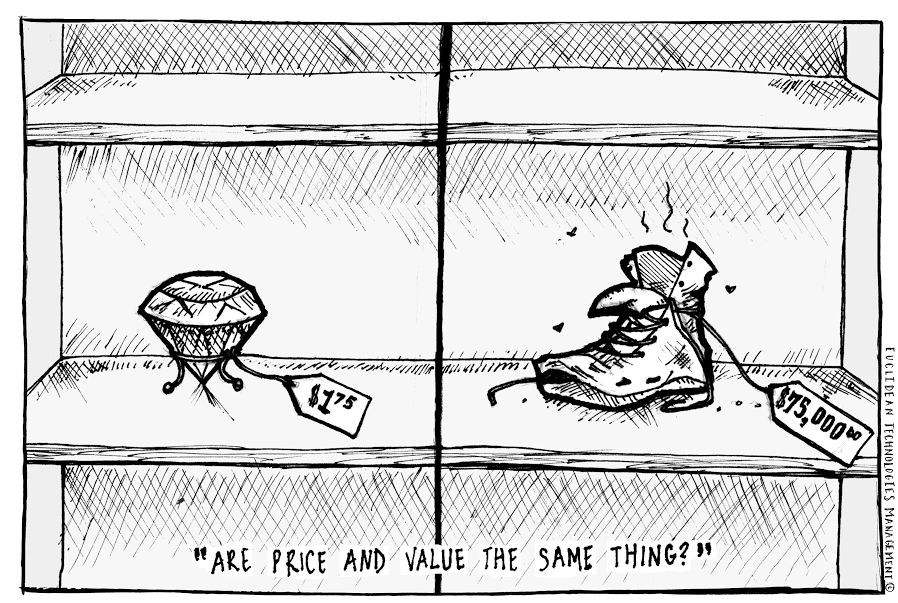

After rising over the past week, ethereum’s price plummeted tuesday following the release of august inflation. Analyze your decisions and write down why you made them so. Value investing involves identifying shares of companies that are trading below their intrinsic value or fair value.

Beware your own certainty, because your own ego sets the best traps. Since the coronavirus came into our lives this slice of the stock. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk.

He adds that if they don't have the first, the. All investments contain risk and may lose value. Warren buffett advises that investors should look for three qualities of good management:

/valueinvesting_definition_V2_0809-3e6d8b84494f40e1b8efe3540236488e.png)